Hamell Retail founders and Noosa holidaymakers Daniel and Kylee Burke have snapped up Tewantin’s Poinciana Place Shopping Centre for $17.5 million, with makeover plans already underway.

The fully leased 3104sqm shopping centre is anchored by Woolworths, representing 77 per cent of the gross lettable area (GLA) and 57 per cent of income. The centre comprises an additional nine retail tenants.

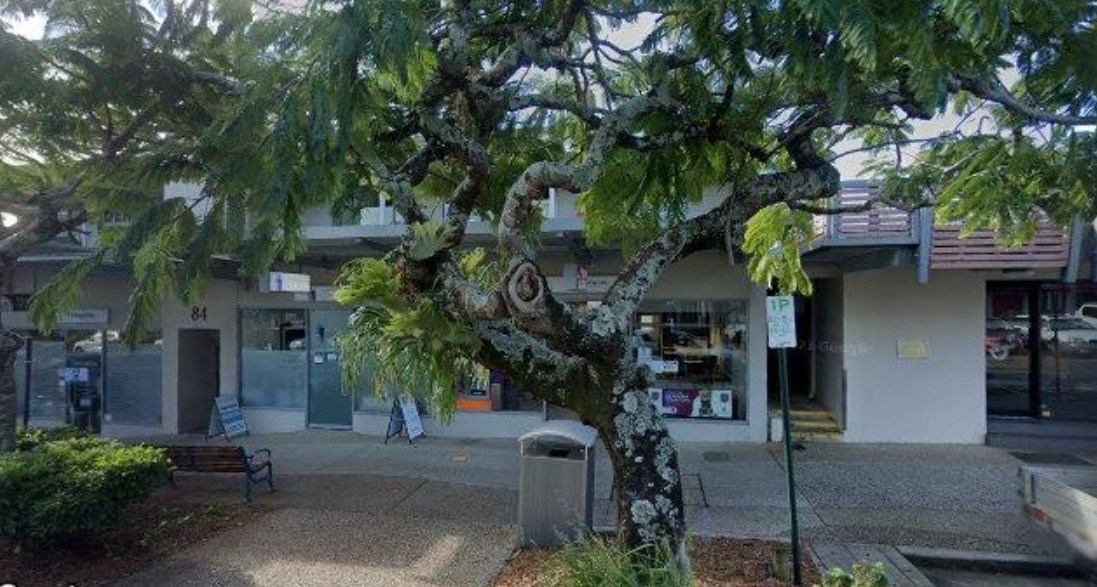

The property at 86 Poinciana Avenue was developed by the Stockwell Group in 2006 and, according to CoreLogic RP data, was sold to a Melbourne investor in 2017 for $17.3 million. Before that, the property was last traded in 2013 for $12 million.

The Burkes are known for their value-add strategies with retail property in the South-East Queensland markets, including the recently completed $20m expansion and repositioning of the Woolworths-anchored Camp Hill Marketplace.

“We are excited. I always tend to take notice of that centre whenever we’re up there,” Mr Burke said.

“We have a holiday house at Noosa, but that’s not the real reason we bought it.

“I just like the size of it and the fact that it was a main street position and not just a standalone out in the suburbs. That was attractive to me.

“I think the demographic is changing enormously up there – that was another reason we liked it. Tewantin is also a really nice and pretty little town.”

With the former owners and centre managers living in Melbourne, Mr Burke said the existing tenants would benefit from now having more “hands on” owners.

“You can see when you look at the centre that the owners are just absentees,” he said.

“There’s been no real contact and no support for them.

“There’s little bits and pieces that need to be done on centres like that all the time, so we will be giving it the love it hasn’t had. That’s also been reflected in the sale price.”

He said the newest acquisition gave the opportunity to largely replicate the strategy used in driving the success of Camp Hill Marketplace.

“The plan over the next few years is to do a similar thing at Poinciana Place, which will be a shuffle of tenancies and refurbishments,” he said.

“You start refurbishing and brightening it up and it will certainly help the businesses.

“We are looking to expand into more similar-sized shopping centres that are either Woolworths or Coles-based in the future. They are attractive tenants.

“In the next few years, that Woolworths will really pick up its turnover and with some good supported and supporting tenants, it will be great centre and a good thing for Tewantin.”

While they have recently appointed Renegade Design Studio for the renovations, he said they would not be doing anything “major” to the centre right away.

“We’re going to pull out all the timber strips off the front and get it re-painted and re-landscaped and all those sorts of things first,” he said.

“It will be a slow rise to the top.

“It will depend on how far the refurb goes as to whether we will be required to lodge a DA or not.”

He said they would not be expanding the centre at this point unless they were to acquire some adjoining property.

“None of the adjoining properties are for sale at the moment that I’m aware of, but they could be over time,” he said.

“Over a period of time at Camp Hill, we managed to buy five or six other properties and that’s how we did our expansions there.

“So who knows, some people might want to sell out over the next few years and maybe not, so watch this space.”

CBRE’s Joe Tynan, Michael Hedger and Louisa Blennerhassett conducted the on-market expression of interest campaign, with Vinci Carbone’s Frank Vinci as transaction adviser.

“The sale achieved a 5.49 per cent yield, which represents a very strong result in light of the market volatility, short WALE (weighted average lease expiry) and requirement for immediate cap ex (capital expenditure),” Mr Tynan said.

“It was a very competitive EOI process. We received 160 inquiries resulting in eight formal bids. In the final round there were three bids around the same price with the top party selected on their terms and capacity to complete in a short timeframe.

“Investors were attracted to Woolworths, which is currently generating sales 14 per cent above the Urbis average and paying percentage rent. Woolworths is further supported by a national tenancy profile that represents 83 per cent of the gross passing income.”

Mr Hedger said pricing for neighbourhood shopping centres appeared to be holding up better than other asset classes in the current higher interest rate environment.

“The key reason is the smaller transaction size, which is attractive to private investors who may not require any debt,” he said.

“Also, supermarkets have been resilient with sales generally increasing with inflation, which drives income for these assets.”

Help us deliver more news by registering for our FREE daily news feed. All it requires is your name and email at the bottom of this article.