Two electorates on the Sunshine Coast are among the least affordable areas to buy a house in Queensland.

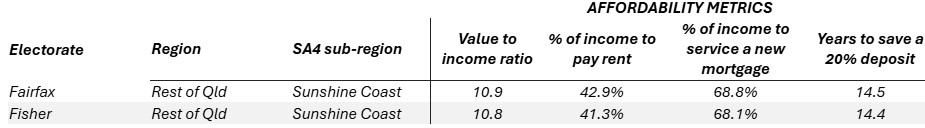

A study in the lead-up to the federal election revealed that Fairfax and Fisher were the second and third least affordable housing markets in the state.

The data from Cotality, formerly CoreLogic, showed that the annual income-to-dwelling values in the two districts was almost 11 at the end of last year, compared to 7.9 across Queensland.

A median income household, about $96,000 a year, would require around 14.5 years to save a 20 per cent deposit and would need to put more than 68 per cent of income into servicing a mortgage.

Cotality’s head of research Eliza Owen told Sunshine Coast News that it was becoming harder for buyers to enter the market in the region.

“Recent cost-of-living pressures has weighed on the household savings rate and rising rent costs have created a double whammy for those looking to save a deposit on rapidly rising home values,” she said.

Want more free local news? Follow Sunshine Coast News on Facebook, LinkedIn and Instagram, and sign up for our FREE daily news email.

“Based on current interest rates, a new mortgage on the median value dwelling (just under $1.1 million) would be simply unfeasible in these areas.

“This is due to rapidly rising home values but also the lift in the RBA cash rate from lows in 2021-22.”

Affordability in the two areas had deteriorated significantly from the 2010s.

The value-to-income ratio in Fairfax has increased from 7.4 to 10.9 in five years. In Fisher it has increased from 7.5 to 10.8.

Ms Owen said the Sunshine Coast real estate market had boomed off the back of the pandemic, making it more difficult for many people to buy.

“Since COVID, Sunshine Coast home values are up 66.8 per cent,” she said.

“Household incomes only rose around 22 per cent across both electorates, and interest rates, although starting to move lower, are very high relative to where they were three to four years ago.”

Ms Owen said interstate migration, a lack of housing and the region’s reputation as a holiday haven contributed to higher house prices.

“Queensland has seen a strong population influx in recent years, mainly from the southern states, and a reduction in people leaving the sunshine state, which has very quickly created an acute shortage of housing,” she said.

“Housing, unlike quick population flows, is relatively slow to supply.

“The Sunshine Coast saw a lot of value realised because of remote work arrangements through the pandemic and ABS data indicates the remote work trend has been fairly sticky in the post-covid period too.

“For the Sunshine Coast in particular, being a popular domestic holiday spot has also likely created added pressures, as long-term residents compete for housing with investors in short term accommodation.”

Ms Owen said many prospective buyers were “being priced out” and house costs had “become detached from local incomes”.

“This has led to many people seeking additional support for the initial deposit and transaction costs of a home,” she said.

“Hence the rise of the ‘bank of Mum and Dad’.”

Ms Owen said houses could remain relatively unaffordable for many for years to come.

“Policies like the first home loan guarantee can help to level the playing field, slashing the time it takes for first home buyers to accumulate a deposit without incurring LMI, but it may also have the adverse effect of pushing values higher up to the price cap limits of the policy,” she said.

“Across the Sunshine Coast, there has not been much sign of a slowdown in home values through the start of the year.

“In the three months to April, Sunshine Coast home values increased 1.5 per cent with a median dwelling value of $1.1 million.

“If anything, falling interest rates are expected to further support home value increases in 2025.

“The only real aspect of affordability set to improve as a result would be the portion of income to service a mortgage. Other metrics are expected to continue to deteriorate as a result of rising prices in the short term.”

The LNP federal member for Fairfax, deputy leader of the Opposition Ted O’Brien, said the Sunshine Coast was rapidly growing and housing supply must be boosted.

“There’s no question the COVID pandemic drove a surge in local house prices, as our southern neighbours fled city life in search of lifestyle and space,” he said.

“The Sunshine Coast’s natural beauty and laid-back lifestyle make it an enviable drawcard, but that popularity is a doubled edged sword for our housing market.

“While the Coalition is reviewing its policies post-election, some fundamentals remain clear – the best way to sustainably lower house prices is to increase housing supply.”

“The Coalition is intent on reviving the dream of home ownership and will be engaging closely with the community as we work to develop a new suite of policies.”

Francine Wiig, who unsuccessfully ran as an independent for Fairfax, said “the system is broken”.

“These numbers are shocking, but they’re no surprise to the people living it,” she said.

“Families, workers and retirees are being priced out of the community they helped build.”

She urged reforms to housing policy, including boosting housing supply, cracking down on land banking, expanding affordable models like tiny homes and strengthening renters’ rights.

The member for Fisher, LNP’s Andrew Wallace, was contacted for comment.