After a surprising year in real estate, experts have revealed their expectations for Sunshine Coast property in 2024.

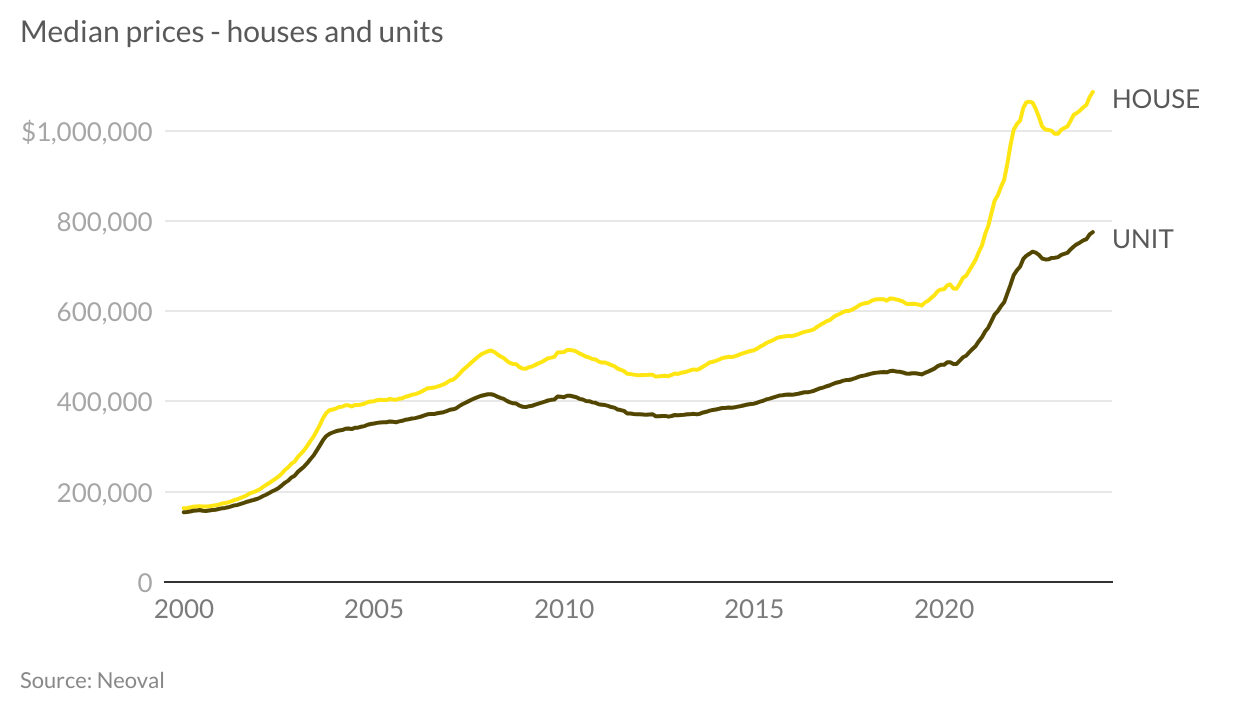

There were some shocks in 2023, when median prices in the region climbed at a rapid rate to reach record levels, according to Ray White data.

House values jumped from $993,070 to $1,085,742, while unit values leapt from $719,817 to $775,197.

Ray White chief economist Nerida Conisbee said the rise caught many people off guard.

“It was a really strong year for the Sunshine Coast,” she said. “There was no slowdown in pricing.”

Do you have an opinion to share? Submit a Letter to the Editor at Sunshine Coast News via news@sunshinecoastnews.com.au. You must include your name and suburb.

“It was surprising because at the start of the year there were a lot of people saying that prices would plummet in many beachside locations, particularly places like the Sunshine Coast.”

That opinion was incited by a drop in prices during the second half of 2022, but the market rebounded in 2023.

“The downturn didn’t really last long at all,” Ms Conisbee said.

Ray White data showed that neighbouring suburbs Parrearra, Bokarina and Buddina experienced the biggest price increases as buyers jostled to be beside the seaside, while Mooloolah Valley and Rosemount saw large gains in the hinterland.

Ms Conisbee said there was several reasons why property values had increased in the region, despite rising interest rates.

Supply and demand played a major role, with a limited number of homes and an influx of people.

“There was definitely population pressure,” she said.

“There has been a lot of people moving to South-East Queensland but rising construction costs have pushed many people into the established home market.

“It’s probably worse in the south-east, where construction costs increased in excess of 35 per cent during the past two years.”

She expected property prices to continue to climb in 2024.

“It looks like it will be more of the same,” she said. “It’s quite possible we’ll see similar rates of growth.

“Interest rates may be cut earlier than expected, which I think will be a factor.

“That’s been a sticking point in the market: the cost of finance has been expensive.

“But if we start to see cuts in interest rates that will fuel the market.”

Ms Conisbee said established homes would continue to attract top dollar, until it reaches a point when buyers preferred to buy new homes and bear the brunt of building costs.

“The pricing has to balance out at some point,” she said.

“Price growth has to keep increasing to match construction costs, which won’t fall.”

And that should lead to more homes eventually being built.

Ms Conisbee said “it is harder to build on the Sunshine Coast” largely due to planning regulations and construction costs but she expected a push for more new homes – by state and federal government – to help alleviate the strain.

She also expected people to continue to move to the region, pushing up prices.

“The general shift in population to South-East Queensland looks like it will continue,” she said.

“It’s a very desirable place to live, and we’re not just getting interstate migration now, we’re getting international migration, so we’re seeing more people settle there than we did in previous cycles.

“There’s been a shift in the perception of the area, of it being a place to live permanently, as opposed to being somewhere just to holiday.”

She said it was a “seller’s market”.

“But most sellers are subsequent buyers. I think one of the things that hopefully happens in 2024 is we start to see a pick-up in the number of properties for sale. A lot of sellers have been sitting on their hands because there is nothing for them to buy,” she said.

Prices set to rise at a slower pace

PropTrack director of economic research Cameron Kusher said there was “superior price growth” on the Sunshine Coast in 2023.

He expected local home prices to keep rising in 2024 but at a slower rate, due to interest rates and inflation.

“The expectation (of slower growth) is due to the delayed impact of interest rate increases and the broader economic slowdown, along with the weakening labour market,” he said.

“We (still) expect prices will rise but they will do so at a slower pace.

“On the Sunshine Coast, home price growth will be dependent on migration to the region and subsequent demand for housing, along with the amount of stock for sale.

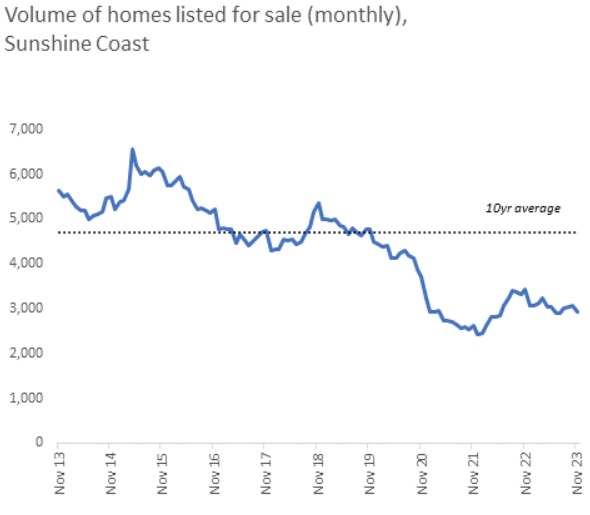

“Supply of stock for sale has been very low on the Sunshine Coast, which has supported prices.”

Housing supply a major issue

CoreLogic head of research Tim Lawless also said a limited amount of housing was a major factor for increased property prices in the region.

“Persistently low available supply has been a feature of the Sunshine Coast market,” he said.

“Through the month of November, CoreLogic was tracking 2944 homes on the market, 14 per cent lower than at the same time last year and 37.5 per cent below the 10-year average number of homes for sale in November.

“Such tight advertised supply levels have generally supported strong selling conditions and kept upwards pressure on prices.”

He said Sunshine Coast housing values had increased at a substantially faster pace than most other regional housing markets and he expected prices to continue to rise in the region.

“But the pace of growth isn’t likely to be anywhere near as strong as the pandemic growth phase where the annual pace of growth reached 38.7 per cent through the 2021 calendar year,” Mr Lawless said.

“A more rapid rise in housing values is likely to be held back by worsening affordability constraints.

“However, strong interstate migration and low supply is likely to keep mild upwards pressure on housing prices.”

He said the number of listings, migration and interest rates would play key roles in 2024.

“Vendor activity will be an important trend to follow,” he said.

“Advertised supply was trending lower through November as buyer demand outweighed the flow of new listings, however if this trend starts to reverse, we could see buyers benefiting from more choice and less urgency in the market.

“Interstate migration trends will also be important to follow. The Sunshine Coast has been one of the most popular regions for internal migrants, supporting demand for housing.

“Interest rates will be another data to point watch closely. There is a growing expectation we could see interest rates start to fall through the second half of 2024. While any rate cuts are likely to be gradual, lower interest rates are likely to have a stimulatory effect on buyer activity.”

Mr Lawless expected housing values to keep slowly climbing to record highs.

“The housing market is highly cyclical with factors like the cost of debt, credit availability, housing supply v demand and sentiment all influencing the trend in housing values,” he said.

“If the growth trend persists across the Sunshine Coast, which looks likely, we are likely to see housing values reach new record highs over the next six months.

“While this might be great news for homeowners, prospective buyers are likely to face increasingly high barriers to market entry as housing affordability worsens.”

CoreLogic data showed hinterland towns like Glass House Mountains, Diddilibah-Rosemount and Nambour had experienced the greatest growth rate during the past 12 months.

More homes on the way

The state government in December released a planning framework – ShapingSEQ – for almost 900,000 more homes by 2046.

The plan underpins more affordable and well-located homes in South-East Queensland, as the region prepares for an additional 2.2 million people.

The release followed months of consultation with communities, local governments and industry around strategies to deliver more homes in the nation’s fastest-growing region.

The plan includes a commitment to 20 per cent social and affordable housing, and well-located units and townhouses. It also includes about 5000 hectares added to the urban footprint for residential and employment purposes, including at Yandina on the Sunshine Coast.

Premier Steven Miles said the plan would enable real housing supply.

“Queensland’s golden decade of growth means that we need more homes than ever before,” he said.

“ShapingSEQ is our response to the national housing supply challenge, ensuring we deliver more homes while preserving our region’s great lifestyle.

“It’s a blueprint for building nearly 900,000 more homes in the right places.

“It’s not just about more homes but making sure that it’s what South-East Queenslanders want, strategically located to meet their needs, reduce costs and increase affordability.”

Real Estate Institute of Queensland CEO Antonia Mercorella said accommodation was a hot topic leading into next year’s state election.

“Housing is a complex challenge and a highly prevalent issue facing our state and will undoubtedly weigh heavily on the minds of voters,” she said.

Help keep independent and fair Sunshine Coast news coming by subscribing to our FREE daily news feed. All it requires is your name and email at the bottom of this article.